5,000 women took part in the 2021 Solo Female Travel Trends Survey (18 November – 9 December 2020) to shed more light on the solo female travel experience. This is the largest, most comprehensive and only global research study on solo female travel trends, preferences and behaviors published. These are the results.

A 2019 non-gender specific study found that 76% of travelers had gone on a solo trip or were considering going. Among women, the interest is even higher and searches for the term “solo female travel” had increased 6 fold during the 4 years preceding the beginning of the COVID 19 pandemic (according to Google trends). Pandemic woes further propelled this type of travel and cemented the interest in independent and individual travel.

These numbers are in stark contrast with the challenges, worries and experiences of women traveling solo. Concerns for safety, misleading advertising or lack of an offer that is sensitive to their needs present relevant opportunities for travel companies who take the lead.

Why solo female travelers should matter to your travel business

The solo female travel segment is large and booming. Women make the overwhelming majority of travel bookings, for themselves, for their families, for their parents, for their colleagues and for their friends, and represent 70% of the hotel website visits. They are the real travel influencers.

Building trust with women offers opportunities to connect at a deeper level with the decision maker in travel beyond the solo trip. A positive experience with a brand as a solo female traveler will open the doors to future purchases as a family, couple, group of friends or even business.

In the travel industry, women occupy the majority of jobs, yet they make up only a small percentage of the executive positions.

Male key decision-makers in tourism cannot understand or relate to the challenges women traveling solo face resulting in the segment being neglected and underserved.

Survey respondent: “Employ more women in executive roles at travel companies so they actually know what it’s like to travel as a woman. Without a seat at the table, decisions are made about us, not with us.”

The narrative in travel is focused on couples and families and does not speak to the solo traveler, let alone the solo female traveler. Therein lies an enormous opportunity for savvy brands to get to know us better and to offer products that understand our challenges.

Run by Solo Female Travelers (FIRST FB group for women who travel solo), the Solo Female Travel Survey was launched at the end of 2020 to bridge the gap between decision makers, the travel industry and women traveling solo.

It is the largest, most comprehensive and only global research study on solo female travel trends, preferences and behaviors published, and aims to shed more light on the solo female travel experience in an effort to provide a platform for dialogue and a path towards normalizing solo travel as a woman.

The survey will be run annually to track changes in perceptions, attitudes, behaviors and preferences over time.

Participants in the Solo Female Travel Survey

We wanted to compare the preferences and attitudes of solo female travelers versus those of women who had not traveled solo yet but wanted to, in order to better understand perceptions and barriers.

5,000 respondents were split between women who had traveled solo and those who had not traveled solo before but wanted to, and each was asked to fill a unique list of questions, with the objective to:

- Provide the travel industry with accurate, updated and detailed solo travel insights, specifically of the needs, preferences, behaviors and challenges of solo female travelers;

- Shed more light into the attitudes of solo female travelers across the world, globally and by region, age group and experience solo traveling, towards marketing efforts, travel providers and destinations.

- Understand the travel preferences of solo female travelers and help the travel industry make data-based decisions on product launches, product details and pricing with solo travel statistics and facts.

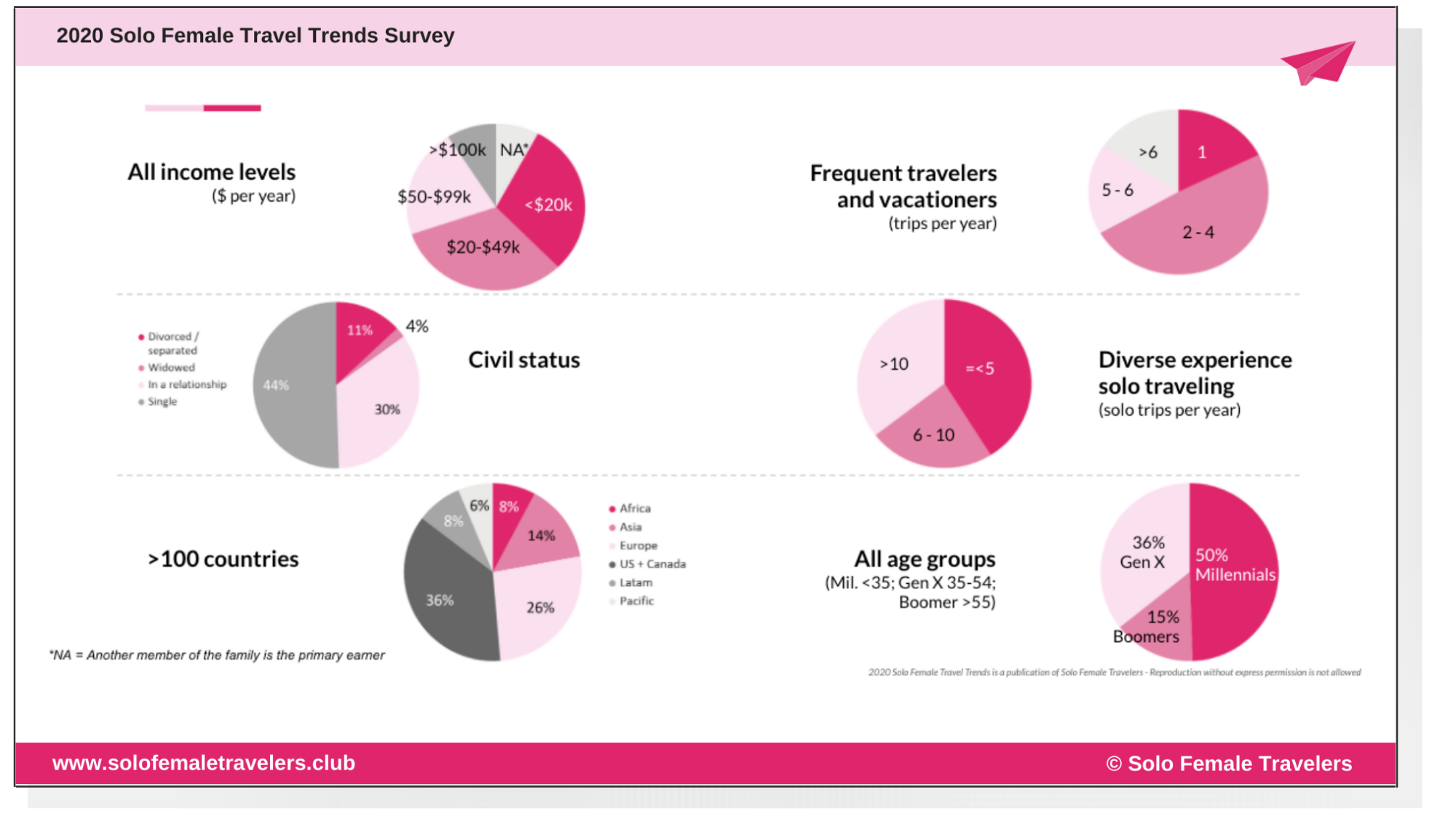

The survey for women who have already traveled solo had 29 questions, which covered socio-demographic indicators, travel preferences, solo travel preferences, behaviors and attitudes. Survey respondents were from all age groups, nationalities, income levels, solo travel experience, marital statuses and profiles.

Details of the participants can be found below.

The survey for women who had not traveled solo yet consisted of 15 questions covering socio-demographic indicators, travel preferences and barriers to solo traveling.

Insights from the survey have been split across three different reports:

1 Motivations and challenges for women traveling solo

Understanding the challenges and motivations of women who travel on their own, particularly around safety, and the sources considered most trustworthy for travel advice.

2 Purchasing behaviors of solo female travelers

The top bucketlist destinations of solo female travelers, how she chooses a destination, and what factors influence her purchasing decisions.

3 Values, Accommodation Preferences and Interest in Retreats

A travel profile of who the Solo Female Traveler is, what she cares about, what she spends money on, and what she wants from the travel industry.

When questions on recent travel were asked, respondents were asked to refer to the 12 months pre-COVID.

Also on this page: Purchase the detailed reports I Learn how you can better serve solo female travelers

Solo Female Travel Survey – Part I: Motivations and challenges for women traveling solo

There are countless stereotypes and misconceptions around women traveling solo. One of our main objectives with this survey was to dispel them and to normalize solo travel for women.

While the solo female travel segment is incredibly diverse, there are common challenges all women traveling solo face and which are unique to the female experience.

Key Findings:

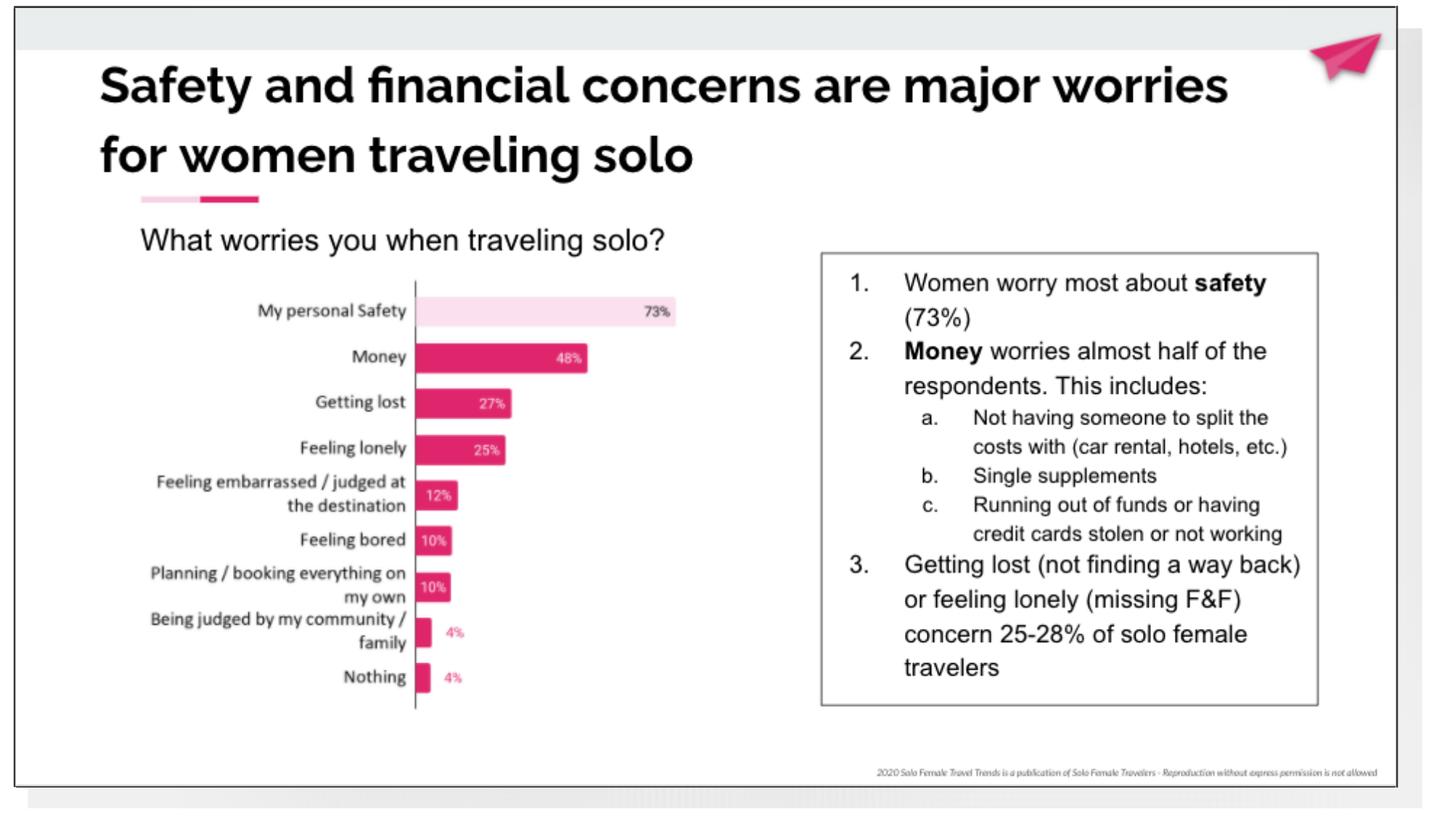

1. 73% of women traveling solo worry about their safety, even experienced solo travelers do (64%). This is a universal concern across geography and age groups.

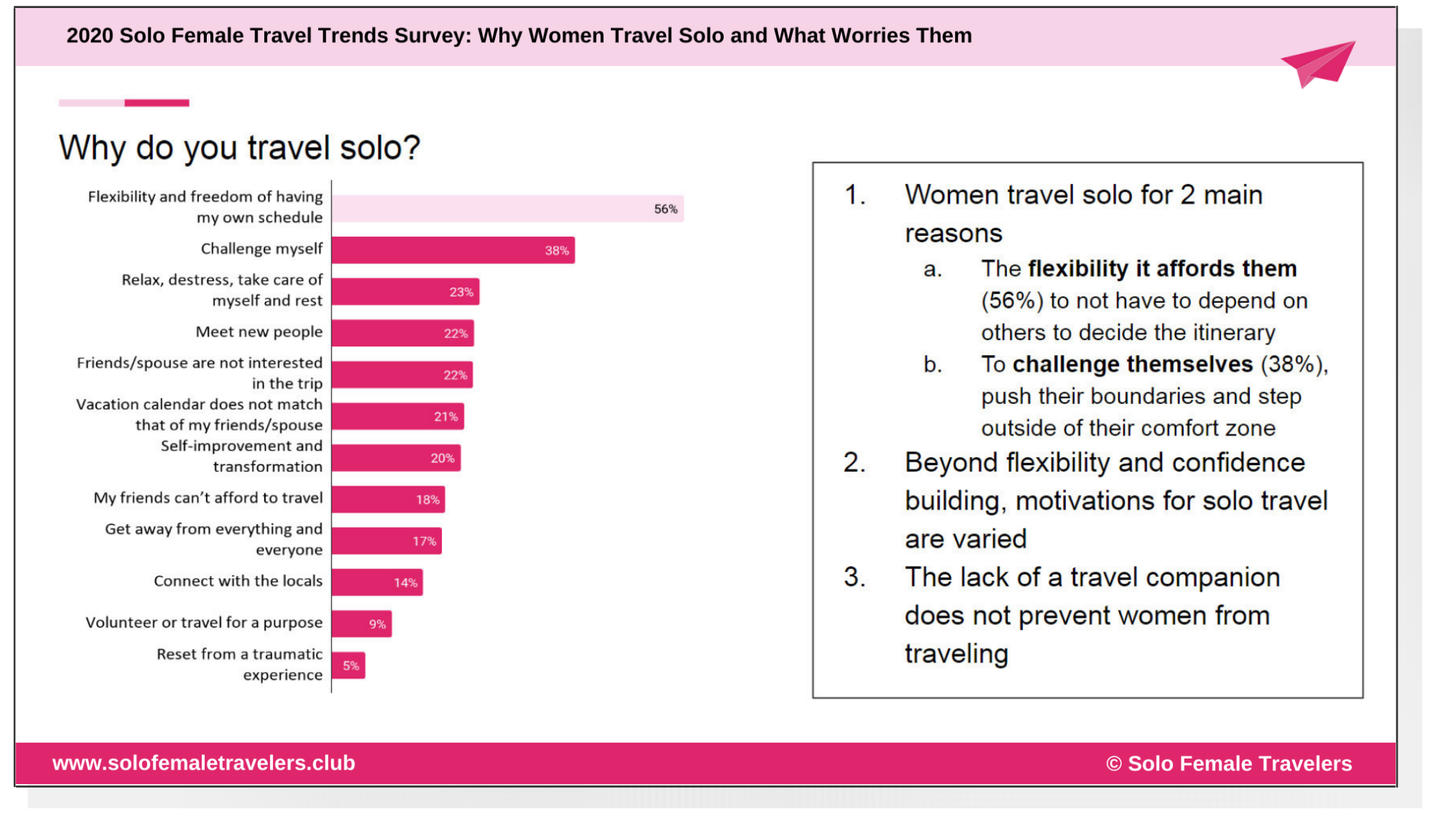

2. Women travel solo for many reasons, particularly for freedom and flexibility (56%), to challenge themselves (38%), enjoy me-time (23%) and meet new people (22%).

3. Women traveling solo trust the advice from solo female travel Facebook groups (73%), blogs (66%), distrust influencers (23%) more than they distrust the travel brands who hire them (16%).

4. Top destinations for first-time solo travelers: Spain, UK, Thailand, Japan, Italy and Australia.

1. Traveling solo is a choice not necessarily a lifestyle

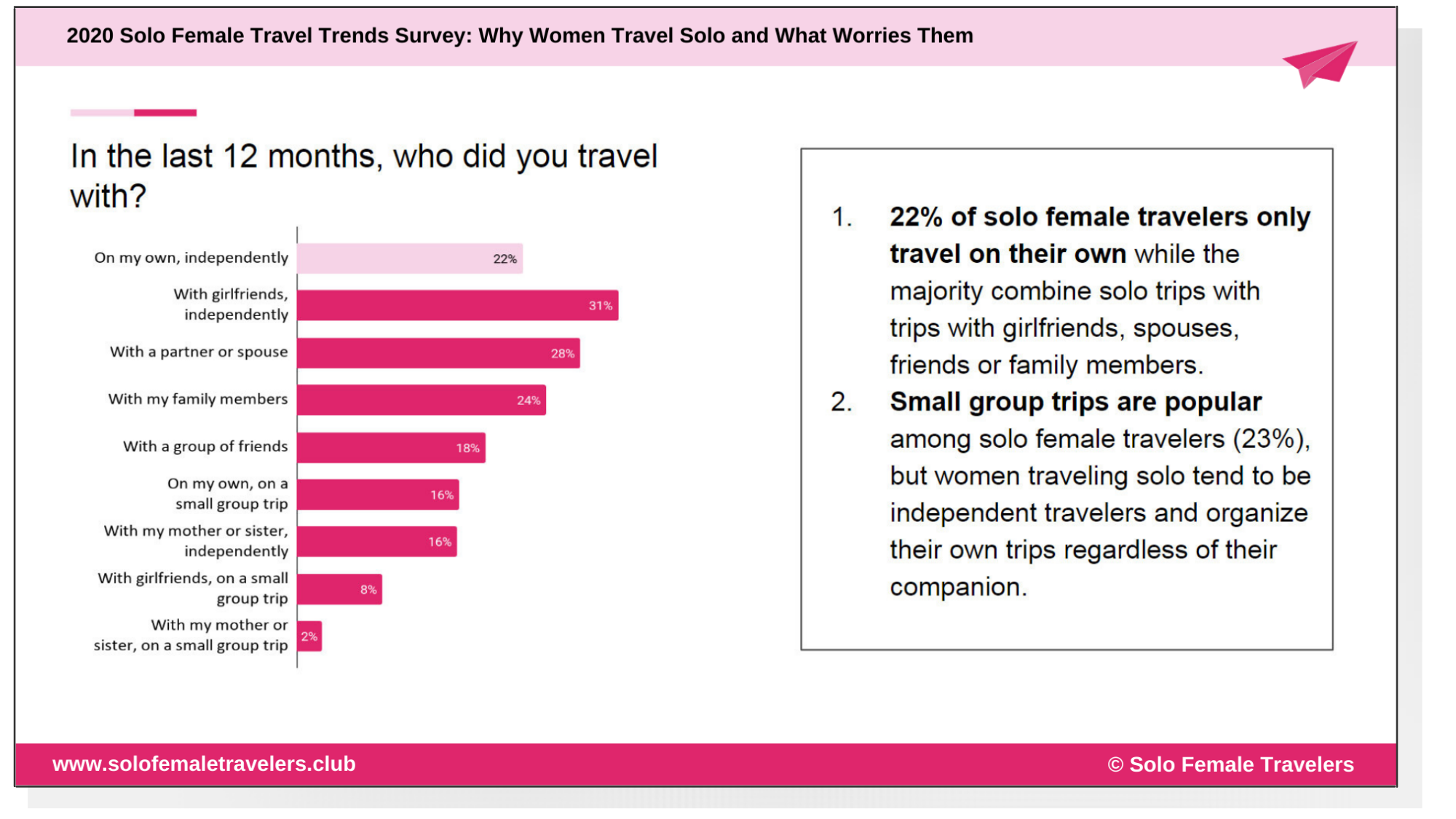

For 22% of respondents, solo travel is a lifestyle and the only way they traveled in the previous 12 months.

However, for the majority, solo travel is a way to explore the world that is a personal choice and has many advantages, but is not the exclusive way to travel. Sometimes, women prefer to travel solo and other times solo travel is just a means to discovering a destination rather than the goal in itself.

When traveling solo, women have different preferences, worries and motivations than when they travel with someone, and are in a different state of mind.

Ashley: “I would like to see that the ability to travel as a woman becomes a norm rather than something shocking.”

Findings / Key Insights

- 78% of solo female travelers combine various travel styles and companions depending on the destination and type of trip. This means that she is not exclusively a Solo Female Traveler, but she likes to take trips on her own and with others. Women traveling solo may go on a road trip with friends or if they are not available, will head out alone.

- A third of solo female travelers also travel with their spouses. 24% of them traveled with their families and 18% traveled with a group of friends in the same period.

- 17% of solo female travelers also joined a small group trip in the last 12 months. Small group trips are a safe, affordable and convenient way to visit challenging destinations or to test solo travel in a predefined way.

Opportunities for the travel industry

- Launch products tailored at the solo female travel niche, considering her needs and wants and her challenges and worries. Reach out to us to discuss how we can help.

- Offer products that cater to women who like traveling solo, rather than to exclusively solo female travelers and understand that, for 78%, solo travel is a travel style and state of mind but not a type of traveler.

- If your company focuses on the solo niche, understand the motivations behind taking a trip alone and tailor the message accordingly.

2. No partner, no problem.

Sometimes, solo travel is a personal choice over traveling with a companion, other times it is consequence of not having a travel companion for the trip. Either way, solo female travelers are not letting the lack of a travel companion stand in the way of a trip.

Findings / Key Insights

- 56% prefer traveling on their own because of the flexibility it affords to explore without having to rely on other opinions and preferences. This is particularly true of women in committed relationships (60%) and for Boomers (58%).

- 38% of respondents travel solo to challenge themselves. Transformative travel is on the rise, and more so when traveling solo. Travel is a way to discover ourselves and step out of our comfort zone. Millennials are twice as likely to travel for this reason than Boomers.

- 23% travel on their own to relax and get away from it all. Travel is one of the best ways to spend a vacation, re-energize and recharge, and solo travel gives that extra layer of quietness that does not depend on others. This is particularly true of women in the Middle East (22% vs. 13%).

- 18% travel for self-improvement and self-actualization. Traveling solo is one of the most rewarding ways to discover oneself. This motivation decreases significantly with age from 23% for Millennials to 9% for Boomers.

Anonymous: “Moving away from stereotypes of what women like to do while traveling”

- No partner, no problem! Women are not letting the lack of company stop them from traveling. 20% said they travel solo because their partner is not interested in the trip or because they cannot find a travel companion with a similar vacation schedule.

- 22% travel solo to meet new people. This is especially true for those who are not in a committed relationship (25%) as opposed to those who are (15%).

Opportunities for the travel industry

- Tours focused on solo travelers without single supplement offer a way for women to meet new people, and travel even if their travel companions are not available / interested.

- Solo female travelers would be more likely to join a small group trip that offered flexibility and free time along with pre-programmed activities that save money and facilitate logistics / guides.

- Group tours that have a component of personal fulfilment and personal challenge are particularly appealing to Millennials.

3. Safety is the indisputable worry of solo female travelers.

Women are extremely worried about their safety when traveling solo. Experience traveling solo reduces this fear, however it still remains alarmingly high at 64% for those who have traveled solo more than 10 times.

Concerns over safety are unique to the female experience regardless of how experienced a solo traveler is. Respondents specifically worry about the lack of credible sources on real safety data per destination and the travel industry’s marketing efforts to make a destination look safer than it actually is.

Findings / Key Insights

- 73% of solo female travelers worry about their safety. Experience traveling solo reduces this fear from 79% among women who have traveled solo less than 5 times to 64% for those who have traveled more than 10 times on their own.

- Beyond safety, solo female travelers most worry about the higher costs of traveling solo due to single supplements charged (47%), of getting lost (27%) or of feeling lonely (25%).

Cheryl: “Give detailed and very specific info about dangers and incidents, what to do, and where to go if an emergency happens”

- Safety is also a barrier for women to go on a solo trip. 42% of women who haven’t traveled on their own yet cite the fear of something happening to them as the reason for not doing it.

- Removing single supplements is the number one request from solo female travelers to the travel industry. 10% of the respondents mentioned this in an unprompted question.

- Women who have taken between 6 and 10 trips worry about safety, loneliness and getting lost the most. They already have limited experience traveling solo and know what to expect and what can happen, but have not yet build the confidence for safety to be less of a worry.

Opportunities for the travel industry

- The issue of safety is multi-faceted and women traveling solo need: reliable, accurate and actionable safety data from a relevant source and the practical tools to keep themselves safe.

- Our Safety Index for solo female travelers to share their safety advice and experience traveling solo with others. The resource allows any solo female traveler to rate their experience at a destination based on 4 factors: Risk of scam, Risk of theft, Risk of harassment and Attitudes towards women. These are the factors that we know are important in understanding how safe or unsafe a destination is so the solo female traveler can better prepare.

- Solo female travelers now have the opportunity to learn everything they need to stay safe when traveling on their own thanks to Empowerful, a Solo Female Travel Safety, Wellness and Sexual Wellbeing Festival aimed at equipping women with the tools they need to stay safe when traveling.

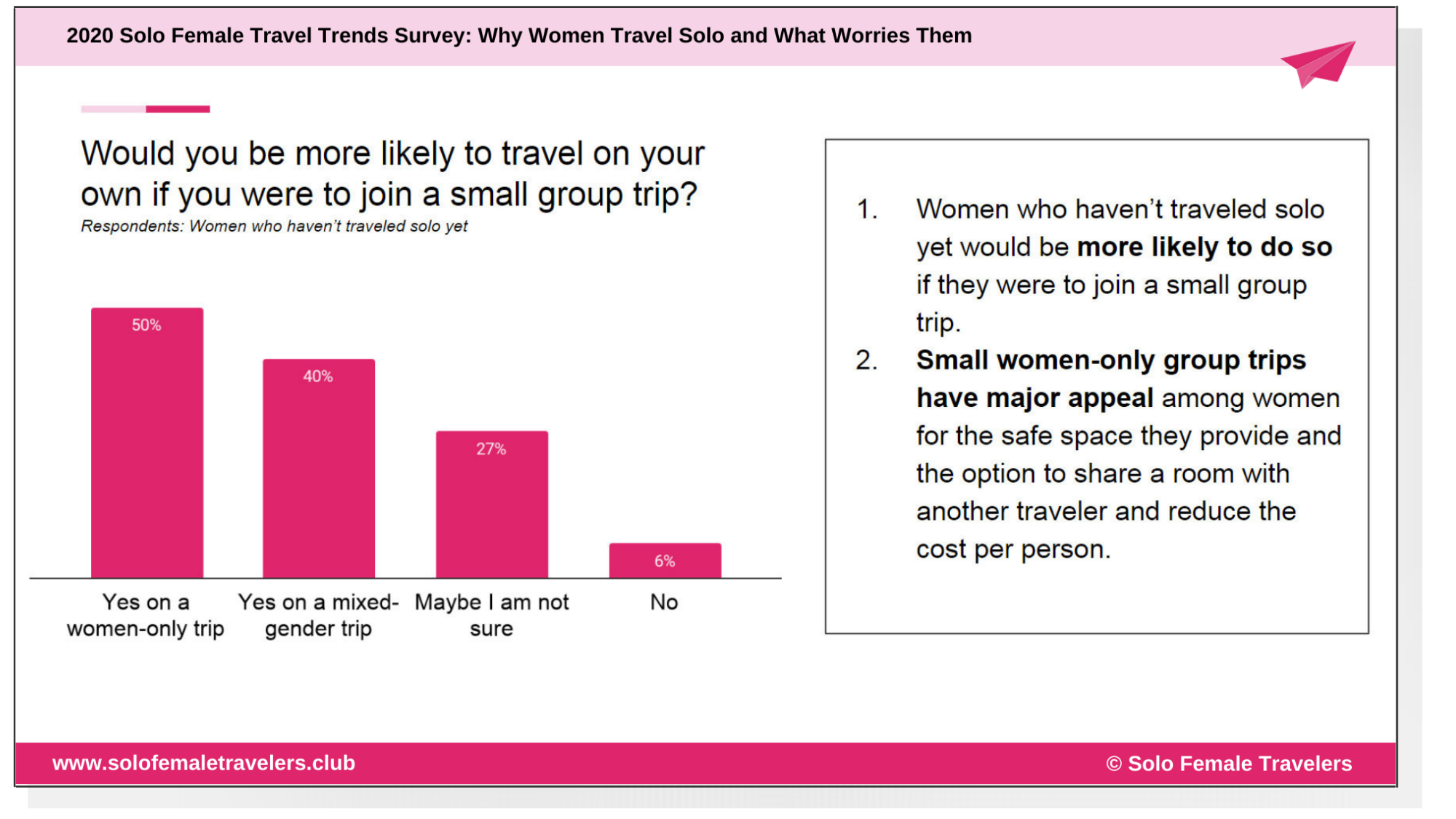

4. Small group trips are a great solution for solo female travelers

When asking women who haven’t traveled solo yet what is stopping them from embarking on their first solo journey beyond safety concerns, the reasons are varied:

- 44% said they can’t afford the higher price.

- 30% mentioned the fear of feeling lonely.

- 19% said their partner does not approve of them traveling alone

- 17% indicated they would feel guilty leaving their family or husband behind

- 13% of women are also concerned about racism and discrimination because of race or religion.

- 5% said their society does not approve of them traveling on their own.

Small group trips help women overcome their safety and financial concerns to travel solo.

Findings / Key Insights

- Half of the women who have not traveled solo yet would be more likely to do so in a group tour, particularly if it is a women-only group tour (50% vs 40% for mixed gender group tour).

Opportunities for the travel industry

- Small women-only group trips have major potential among women for the safe space they provide and the option to share a room with another traveler and reduce the cost per person. They tackle all concerns and worries of women traveling solo and are a great way for them to dip their toes into the world of solo travel.

- Female-only tours targeted at solo travelers have an additional level of comfort and offer an option to women who want to travel solo to share room costs and meet people without the stigma of being alone.

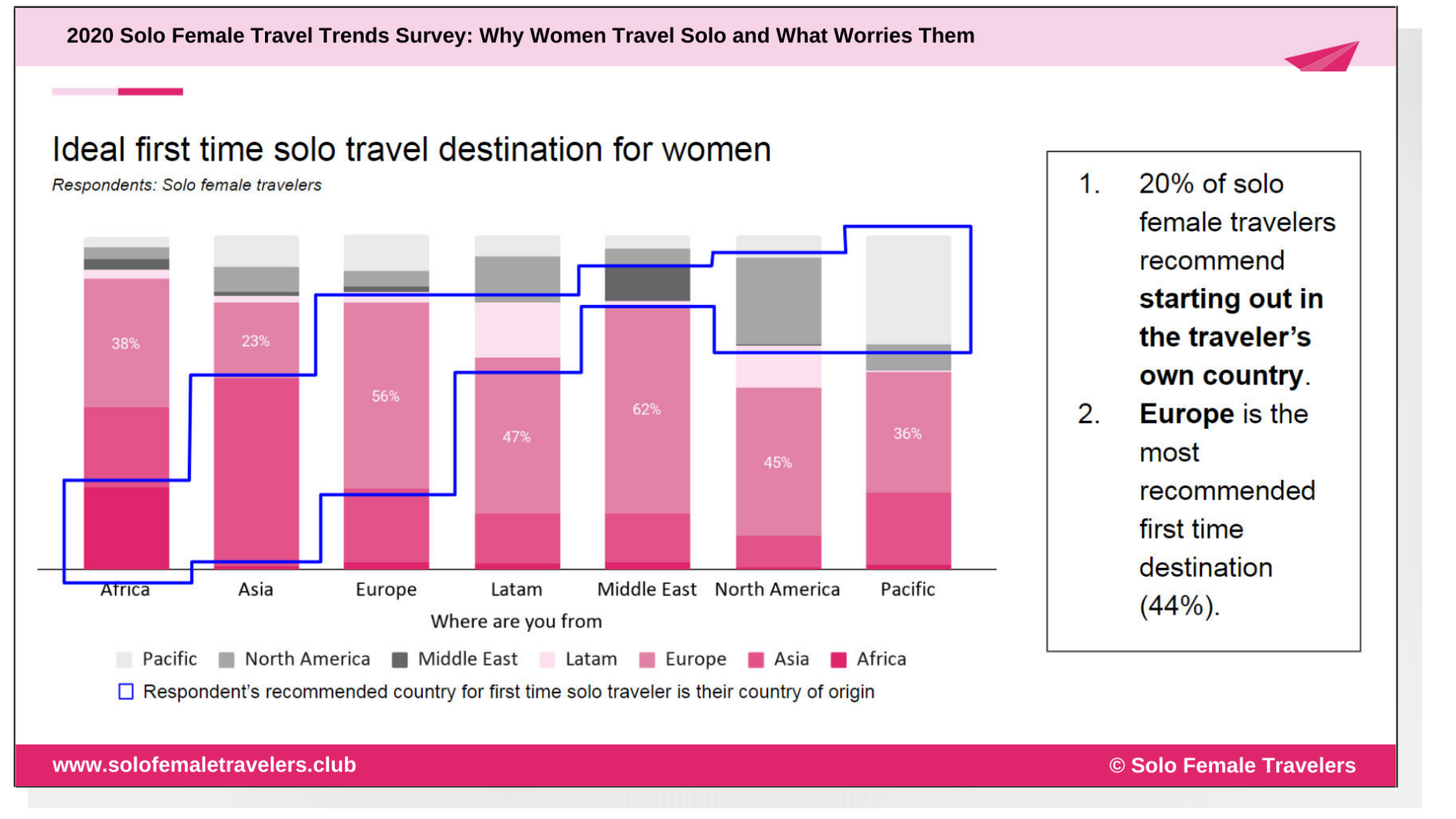

5. The ideal first-time solo travel destination is your own country or in Europe

Solo female travelers should start off either in Europe or in the travelers country of origin, where the culture shock is lower (same country, language, similar culture and traditions, etc.).

It is also worth noting that, while there are some universally recommended options for the ideal destination a first time solo traveler should start with, there isn’t a one-size-fits-all choice and each traveler should consider their own personal circumstances when deciding.

Findings / Key Insights

- 20% of solo female travelers recommend the travelers country of origin as the best destination for a first time solo trip.

- 44% of solo female travelers recommend Europe as the ideal first time solo travel destination for women.

- The top countries for solo female travelers are the UK, Australia, Italy, Thailand, Spain and Japan, be it because:

- They are major tourism destinations (Spain, UK, Italy).

- They enjoy really high levels of safety (Japan, Thailand).

- They have great tourism infrastructure (Spain, Thailand, Italy).

- They are affordable (Thailand, Spain).

- They have friendly locals (Australia, Thailand, Italy, Spain).

- They see a constant stream of solo travelers to beat loneliness and boredom (Spain, Thailand).

- Women who haven’t traveled solo yet consider Italy, Greece, France, Australia and Japan ideal first solo travel destinations while Americans and Canadians prefer their own countries for a first solo trip. 11% of women are not sure what the ideal first time destination would be.

Opportunities for the travel industry

- Provide transparent and reliable safety information at the granular level of the neighbourhood or city with actionable, practical and solo female focused tips to stay safe to complement our Solo Female Travel Safety Index.

- Training hospitality staff members to better cater to solo female travelers. Our experienced team can arm your team with the right resources and mindset to help your business become solo female travel trusted.

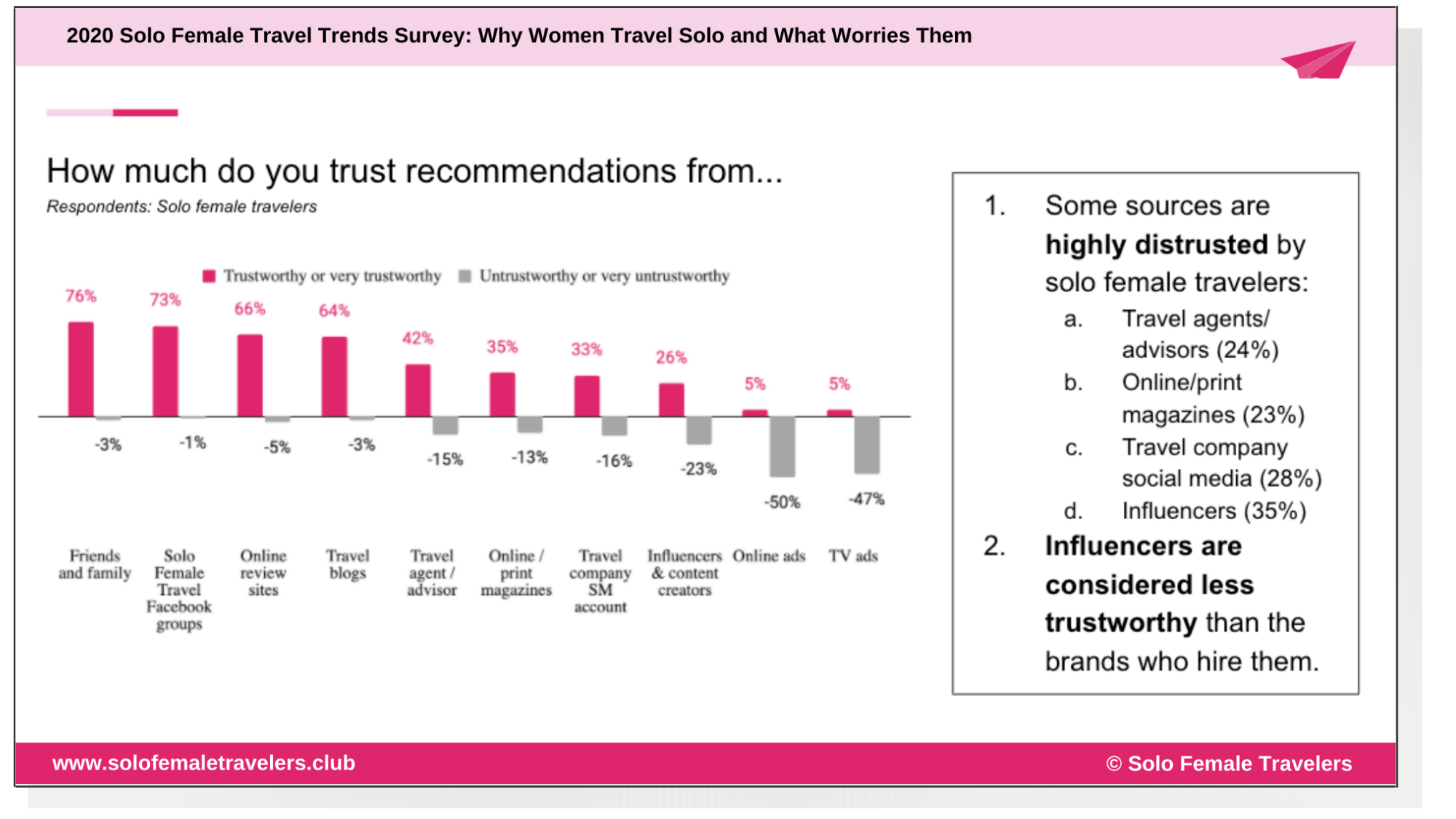

6. Friends and Family and SFT online communities are the most trusted sources of advice. Influencers are not trustworthy

When planning a solo trip as a woman, getting trustworthy and relevant advice is critical and can make or break a trip, especially when it comes to safety tips and recommendations for things to do or places to stay.

Recommendations from Friends and family are most trustworthy across age groups, closely followed by recommendations from other solo female travelers in Facebook groups with likeminded individuals.

Context and relatability matter, and solo female travelers want to hear from other women who travel solo within the safe environment of an online community of like minded individuals. This reinforces the previous finding that safety is a multi-faceted issue and women traveling solo demand reliable, accurate and actionable safety data from a relevant source and the practical tools to keep themselves safe.

Anonymous: “Move away from influencers, it is not genuine and influencers are just a different from of advertising”

Recommendations and advice from Influencers are mostly distrusted, especially by Millennials. They remain a source of information but their trustworthiness is almost as high as their untrustworthiness.

Findings / Key Insights

- Solo female travelers trust relatable (who have been there), reliable (honest) and relevant (like them) sources. Friends and family, solo female travelers, online review sites and blogs are most trusted.

- Influencers are considered less trustworthy than the brands who hire them. Influencers, Instagrammers, YouTubers and other content creators have very low trust levels with only one quarter of respondents considering them trustworthy or very trustworthy sources, this is a lower level of trust than enjoyed by travel brands’ social media networks (31%). More worrisome is the percentage of respondents who find influencers not trustworthy or very untrustworthy (21%), which is higher than the lack of trust towards travel brands’ social media channels (15%).

- Online and TV ads are not trusted by solo female travelers with over 40% of respondents considering them as untrustworthy sources.

- Trustworthiness of digital marketing / social media channels varies significantly by age group. Millennials trust online channels, particularly Facebook groups, online review sites and blogs the most. However, they are more weary of more traditional channels. On the other hand, Boomers are generally skeptical of any online marketing channels and a relevant percentage have either a neutral opinion or no opinion with regards to their trustworthiness.

Opportunities for the travel industry

- Reconsider the role of each marketing channel when targeting solo female travelers and adapt the strategy to the trustworthiness level and the objectives.

- Add Facebook groups and bloggers to the marketing mix and use them as a trusted source of research insights, product development and sales.

- Use content creators, Instagrammers, YouTubers and other influencer higher up in the sales funnel. They are a go-to resource for content creation (photos, videos) and for awareness but not for advice.

- Reach out to us if you would like a tailored report by geographical region, age group or income level to better understand your target market.

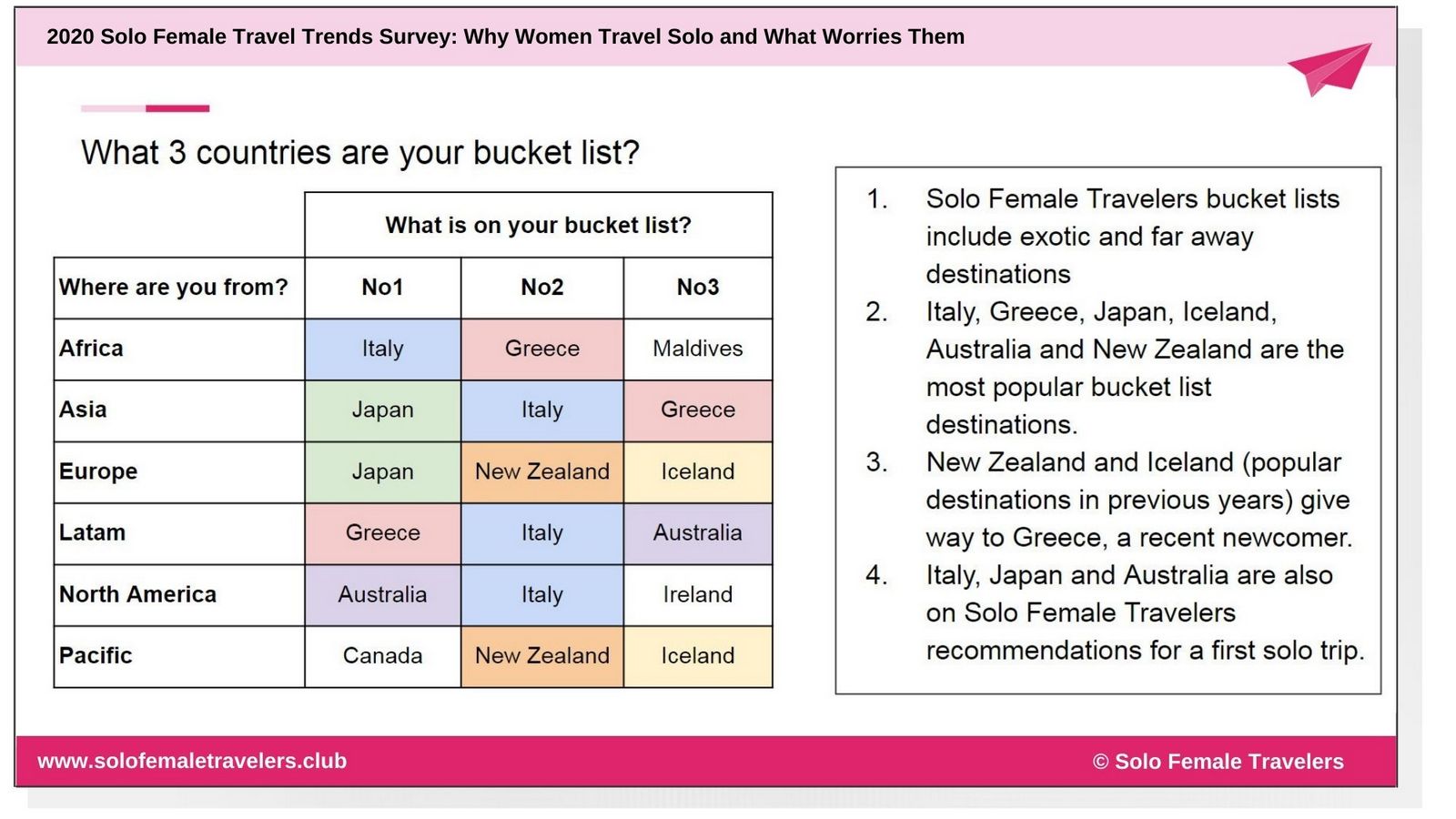

Solo Female Travel Survey – Part II: Preferences and Attitudes of Solo Female Travelers

The second batch of results from the Solo Female Travel Survey focuses on the preferences of women traveling solo and looks at what they like to do when traveling, how they choose a destination and what they would pay more for.

Key Findings:

1. Solo Female Travelers dream of going places that are far away. Their bucket list includes Australia, Japan, Italy, Greece, Iceland and New Zealand, although there are age and regional differences.

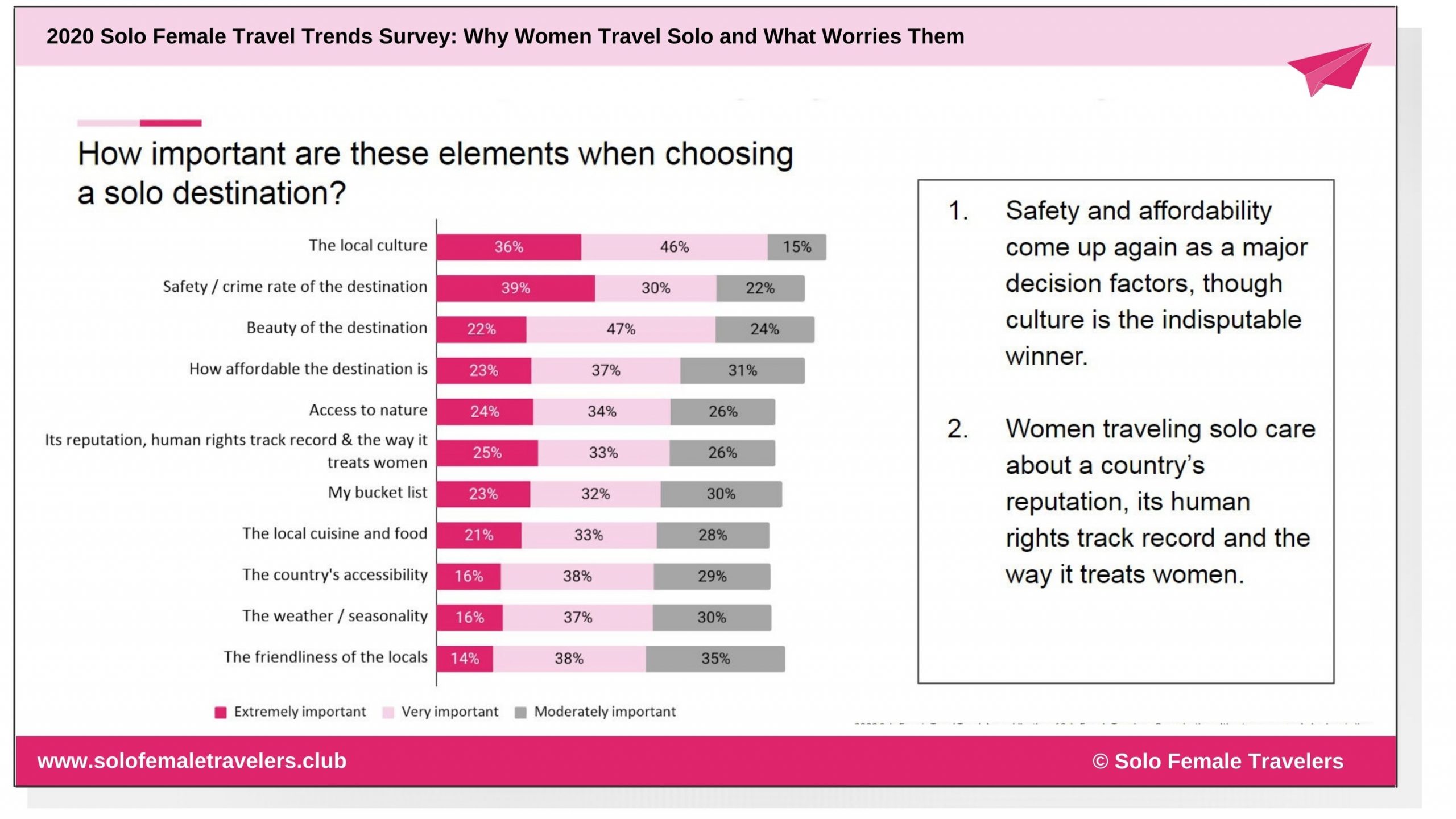

2. When choosing a destination women look for cultural experiences (82%), safety (69%), the beauty of a place (69%), nature (58%) and the country’s reputation (58%). Having opportunities for Instagram shots, spending time at the spa or shopping are not important.

3. Affordability of a destination is a decision factor for 60% of respondents and single supplements are mentioned as a major barrier to traveling solo.

4. Solo female travelers would spend additional travel budget on better accommodation.

5. Women like to engage in a wide range of activities when traveling solo but culture and nature / wildlife come out on top.

1. Solo Female Travelers dream of places far away and exotic

Women traveling on their own look for places that are far from where they live in or are from. While there is some overlap between the bucket list destinations and the recommendations for first time travelers, there are also some countries that appear on the bucket list probably for the first time.

Dream destinations for 2020 are also influenced by COVID restrictions and the timings when countries opened. Greece is one of the winners from travel during COVID times thanks to the fact that they opened earlier than other countries in Europe and is best visited during the summer months when border restrictions relaxed.

Findings / Key Insights

- Top countries on Solo Female Travelers bucket lists include Australia, Japan, Italy, Greece, Iceland and New Zealand. Greece is a newcomer and is particularly appealing to Gen Z travelers as it has everything they look for: Instagram spots, a beautiful destination, the beach, affordability, nightlife and the opportunity to meet people, etc.

- The traveler’s nationality determines the bucket list, with most respondents favoring places that are farther away from home. Australia is particularly appealing to travelers from the US and Canada while Italy or Greece are top choices for everyone but Europeans who prefer Japan, New Zealand or Iceland.

- Age also determines the traveler’s bucket list; Boomers prefer Australia, Canada and Italy while Millennials and Gen-X favor Greece, Japan or New Zealand.

Opportunities for the travel industry

- Destinations on the bucket list for solo female travelers should view the opportunity of latent demand to launch campaigns PR products targeting the segment, including the preferences by nationality and age group.

- Destinations not on the bucket list who want to attract solo female travelers should design campaigns that speak to the needs and preferences of solo female travelers and address our challenges, worries and barriers.

2. Women traveling solo choose destinations based on their culture, their safety, their beauty and their affordability

When choosing a destination, 82% of women traveling solo find the local culture extremely important or very important while 69% consider safety or the crime rate at the destination. Women also look for destinations that are beautiful.

Affordability is an important aspect of the solo travel experience, for men or women, but is even more relevant for women who may not feel comfortable in shared accommodation such as shared hostels, room vacation rentals, etc. Single supplements in particular were mentioned by 10% of respondents as something they wish the travel industry improved on.

Judy: “Do away with single-person fee supplements. Make it an incentive for companies who advocate and accommodate solo female travelers”

Not having a companion to share accommodation and activity costs with could double the cost of a trip, putting affordability at the forefront of the travel decision for solo female travelers. Respondents also raised the misleading campaigns that focus on prices per person but require a minimum two person booking, thus dismissing solo travelers.

Findings / Key Insights

- 82% of women traveling solo find the local culture extremely important or very important when deciding on a trip.

- When choosing a destination, solo female travelers look at several decision factors, from culture to nature, beauty, safety, affordability, food, seasonality, accessibility and friendliness of the locals.

- Safety at the destination or its crime rate comes up again as an important decision factor when choosing a solo travel destination for 69% of respondents.

- A destination’s beauty is another important decision factor for 69% of respondents. This can be the beauty of its landscapes, its architecture, the sights, etc. and means different things to different people.

- 58% of respondents said they care about a country’s reputation, its human and social rights track record and the way it treats women. This shows that solo female travelers are aware of social justice issues and will consider whether a destination aligns with their values when deciding.

- 60% of respondents also care about the affordability of a destination. Traveling solo carries additional costs and the risk of an activity being cancelled because of level of interest. Hostels often charge more for female-only dorms than for mixed ones, even if the service provided is the same.

Carolyn: “Make the cost of staying in a female only dorm the same as in a mixed dorm in hostels. Often it is more expensive to stay in the female only room”

- As would be expected, the lower the disposable income of the respondent, the more important affordability is. While bucket list destinations run the gamut of affordability, with expensive destinations such as New Zealand or Iceland coming up, first time destinations for solo female travelers tend to be more on the affordable side (except for Japan).

Opportunities for the travel industry

- Tourism Boards or travel businesses who want to attract solo female travelers should focus on the aspects that matter the most when choosing a destination: the local culture, safety and affordability. Showing the beauty of a destination is also important as solo female travelers focus on the visual appeal of a place.

- Depending on the type of solo female traveler a business wants to attract and the destination they are in, different aspects will be appealing to women traveling solo. Age groups, nationalities and disposable income are major determining factors when picking a destination and they should be used to convey a marketing message that resonates with the right solo female traveler.

- Accommodation providers have a relevant opportunity to target the solo collective if they offered the option for travelers to share a room, especially travelers of the same gender, this would expand the pool of potential customers and open the doors to solo travelers who can’t afford single supplements.

- Activity providers have an opportunity to address the minimum size of 2 guests for tours to run by partnering with other businesses or specifically attracting solo travelers.

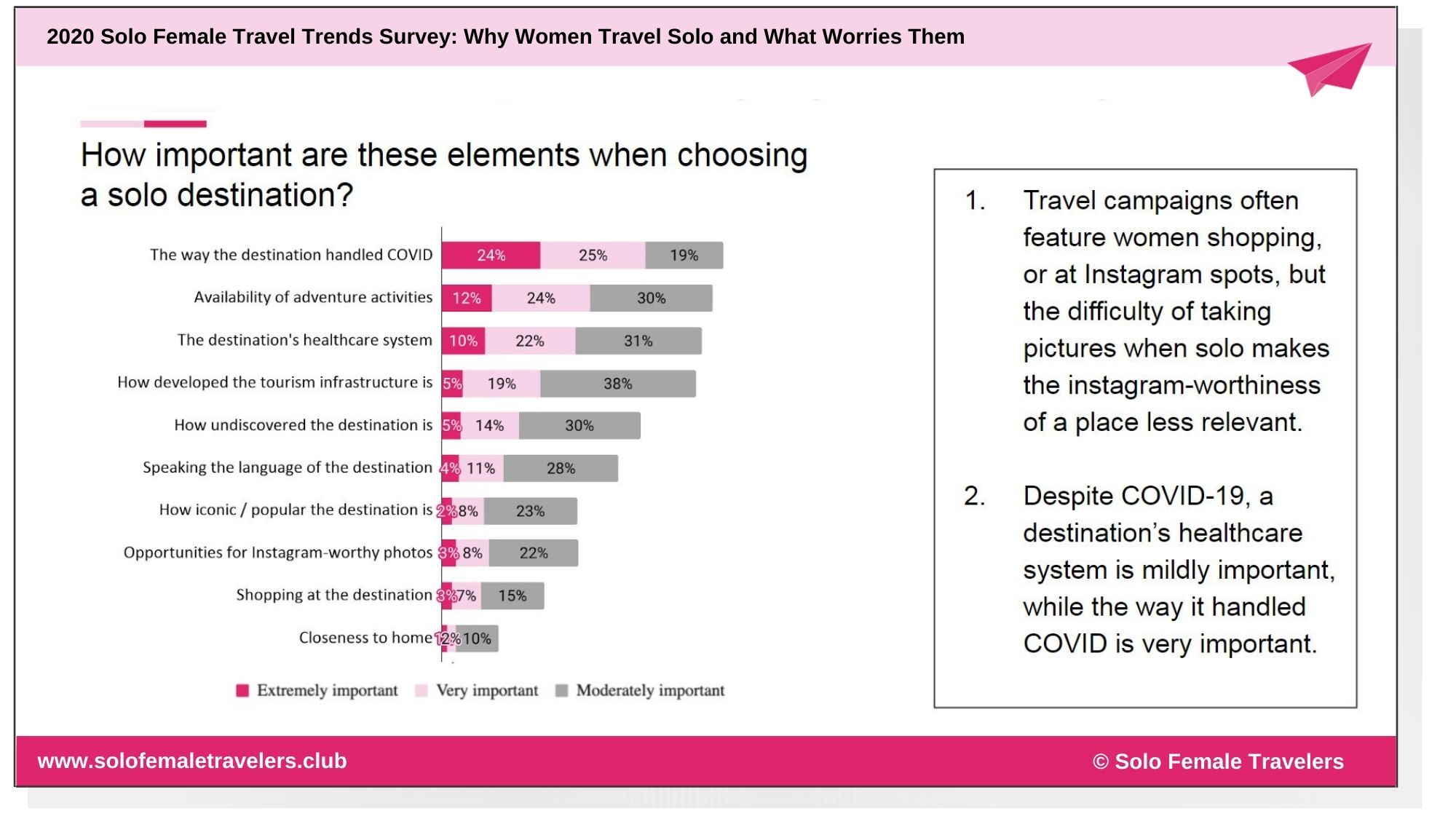

3. Solo female travelers are not interested in shopping or Instagram-worthy spots at the destination

Contrary to common marketing messages and travel brochures, women traveling solo are not choosing a destination based on IG spots, shopping or how iconic a destination is.

This finding may also allude to the fact that traveling solo makes it harder to take lots of staged images for Instagram and solo female travelers are less interested in that. If taking photography or visiting IG worthy spots is a priority, travelers may choose to go with a companion.

Anonymous: “Let’s move away from stereotypes of what women like to do while traveling (it is more than shopping or taking Instagram worthy photos).”

The majority of solo female travelers are adventurous and are not deterred by the distance to get to a place, the language limitation or how developed the tourism infrastructure is. However, a relevant percentage are still concerned about this. The more experienced a solo female traveler is, the less important these elements are.

Findings / Key Insights

- Only around 10% of respondents said that Instagram worthy spots or shopping was an important decision factor when choosing a solo destination. Stereotypes of what women like to do when traveling solo are outdated and not relevant to solo female travelers.

- Language barriers only matter to 15% of respondents, while closeness to home is irrelevant for almost all respondents.

- Basic aspects such as the healthcare system or the tourism infrastructure of a destination are not important to solo female travelers either, as they give way to other more relevant decision factors.

Opportunities for the travel industry

- Marketing materials or messaging showing solo travelers taking popular IG photos or women shopping do not resonate with the solo female travel segment. Tourism businesses should refresh their marketing materials if they want to speak to solo female travelers.

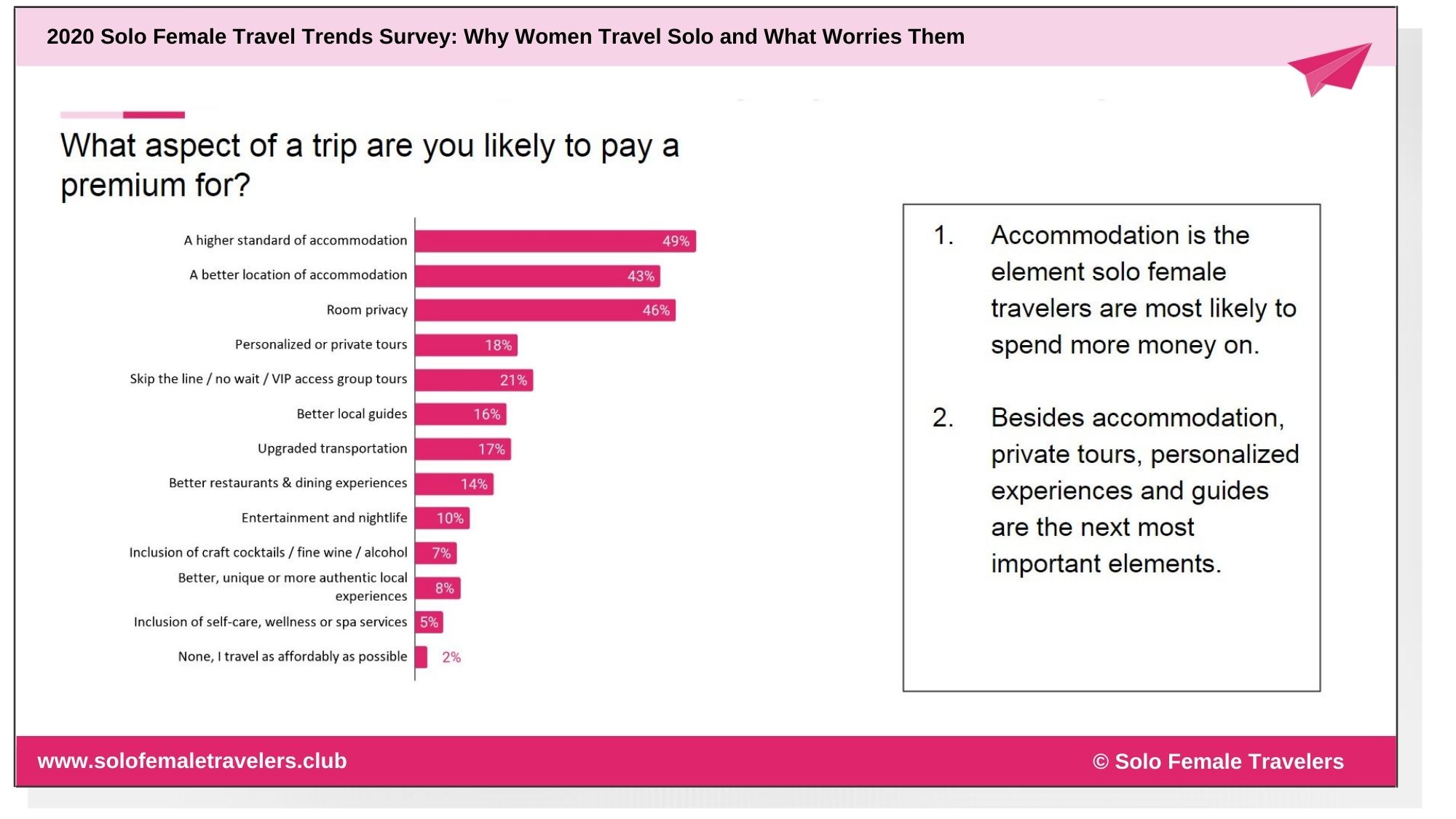

4. Women are willing to spend more on accommodation and tours

We asked women traveling solo what they would splurge on if they had extra budget and the responses illustrate what women traveling solo care about the most: accommodation. Beyond accommodation, the next most important aspect of the travel experience are the tours / activities, although significantly behind accommodation in importance.

Upgrading the accommodation choice during a trip is not only a matter of comfort but it is also a way to improve the traveler’s safety, especially in the sense of privacy or location.

Besides accommodation, a higher budget usually means the opportunity to upgrade the tours and activities by switching to personalised experiences, the convenience of VIP access or of skip the line tickets.

Interestingly, women traveling solo are not willing to sacrifice accommodation in favor of spending more on entertainment, spa services or drinks and extra budget is not often spent on these aspects of the travel experience.

Findings / Key Insights

- Accommodation is the most important element of the travel experience for solo female travelers. If budget was not an issue, 49% of women traveling solo would upgrade their accommodation, 46% would opt for private accommodation and 43% would seek a better location.

- Around a fifth of respondents indicated that they would devote a higher disposable budget to faster and more convenient access to activities, a better local guide or a personalised tour.

Opportunities for the travel industry

- Activity providers should offer the option of VIP tickets or access, skip the lines tickets or premium experiences that are available to just a few travelers and which provide an upgraded experience.

- Shared accommodation providers should could consider adding private rooms with shared facilities that provide a middle-ground for privacy at an affordable price.

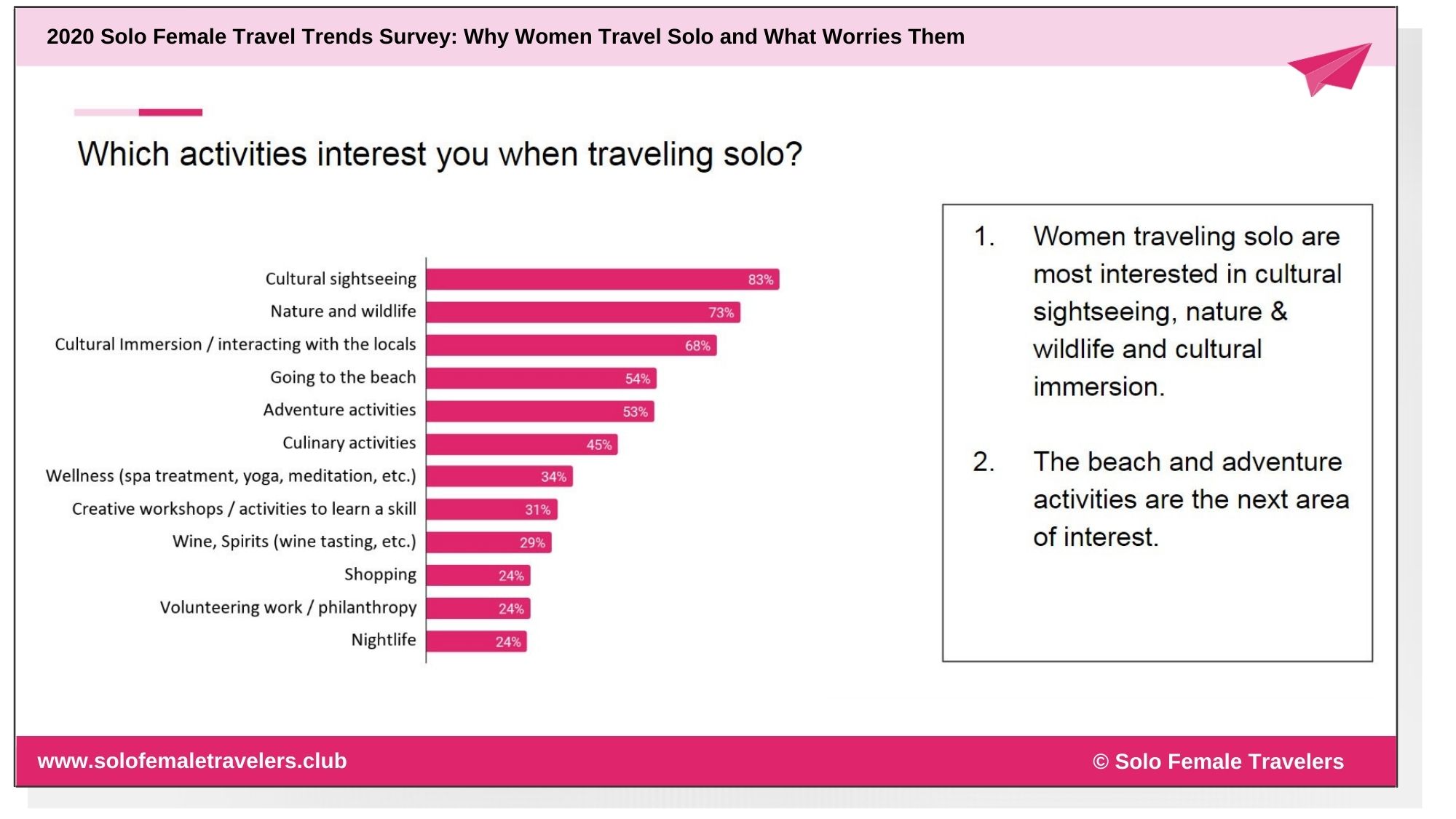

5. Solo Female Travelers are interested in cultural activities and immersion, the outdoors, the beach and adventure activities

Solo travel for women is a growing trend and with that, the types of women traveling solo have also expanded to included women from all walks of live, all age groups, all backgrounds, all nationalities and all ethnicities. This has increased the range of interests, deeming previous ideas around what women like to do when traveling on their own outdated.

Stereotypes around wellness and spa days or shopping are no longer representative of the average solo female traveler who is looking for many different things and travels for a variety of reasons.

Responses to our survey also reflect this diversity and, while culture and nature come up on top, there is then a long list of activities women love doing when traveling on their own. This opens up the space to travel and tourism businesses to offer something unique to each of the subgroups and illustrates that fact that there are not only various sub-segments within the solo female travel niche, but there are also many types of trips women who travel solo embark on.

Findings / Key Insights

Anonymous: “Recognizing that we are not a uniform group, that we don’t all want “girly” activities, and that age categories mean less and less. Older women don’t want automatically want knitting circles and younger women don’t automatically want to go clubbing.”

- The segment is not homogeneous and there are a wide range of activities women traveling solo are interested in partaking in.

- Solo female travelers are interested in cultural sightseeing and activities that involve cultural immersion, followed by nature and wildlife.

- Going to the beach, adventurous or culinary activities are all of interest to half of the solo female travelers.

- Volunteering or helping out are an emerging interest for women traveling solo. Younger solo female travelers are most keen on traveling with a purpose.

- Age determines interest in activities when traveling; the younger the respondent the higher the interest in nightlife and adventure activities. The older the respondent the higher the interest in creative workshops, wellness and culinary activities. However, there is always a relevant percentage of respondents interested in activities generally associated with a different age group.

Opportunities for the travel industry

- Understand that not all young women want nightlife and bungee jumping and that there is a large and growing segment of older women interested in those activities too. Inversely, there are younger women interested in wellness, workshops and culinary workshops. Communication and marketing materials should instead focus on the experience and not on age.

- Tailor specific products to the various types of solo female travelers and the various types of trips the segment embarks on. The same way women travel with different companions and formats (independently, on small female-only tours, on mixed group tours, etc.), they also travel for different reasons and engage on different activities.

Solo Female Travel Survey – Part III: Values, Accommodation Preferences and Interest in Retreats

Decision factors when choosing a travel provider have evolved in the last two decades from big international brands, travel agent recommendations and package deals to a more thoughtful and mindful decision process that looks beyond the surface and into the impact a travel company has on the environment, the local community and society.

Women traveling solo are interested in trips which have a positive impact, and they care about a travel provider’s offer beyond just price. In this section, we explore what motivates women to pick a business when planning a trip, their accommodation preferences when traveling solo, and we take a look into the recent trend in themed trips and retreats.

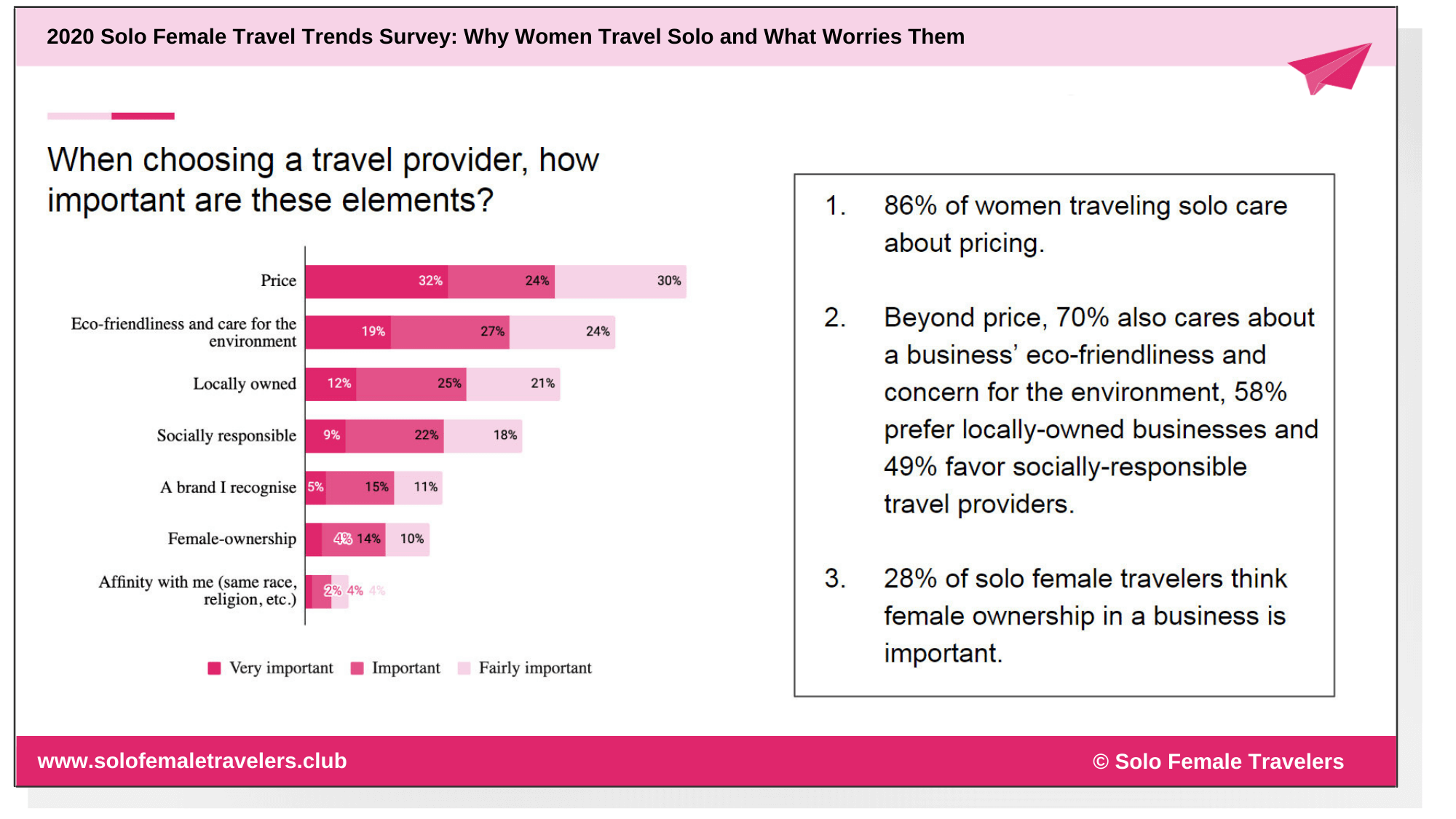

Key Findings:

1. Price drives 56% of women when choosing a travel provider.

2. Beyond price, 46% of women traveling solo think that a travel provider’s eco-friendliness and care for the environment is important or very important, 37% care about whether a business is locally owned, and 31% value its social responsibility. 18% of women value female-owned businesses.

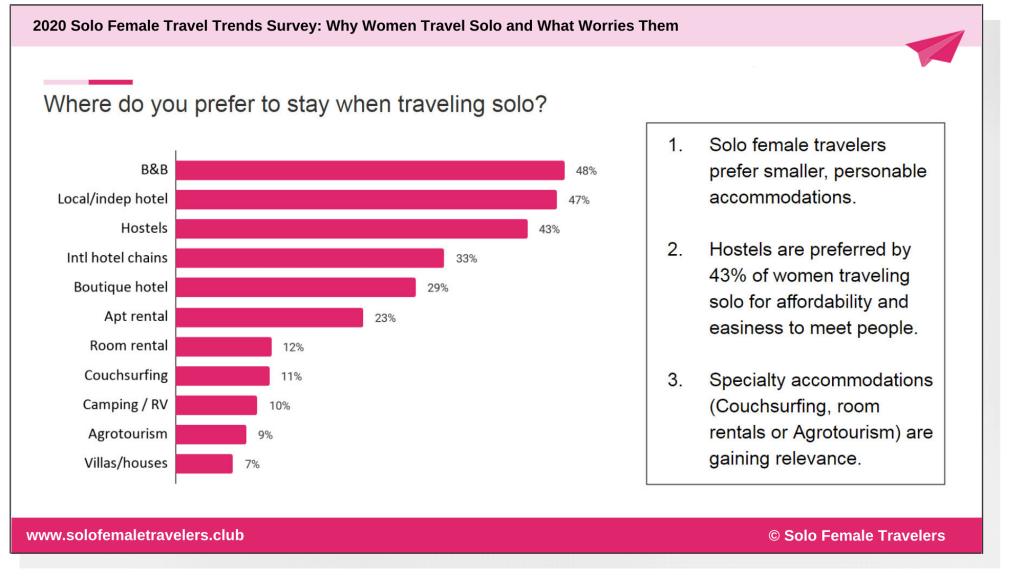

2. Women traveling solo prefer to stay at independently or locally owned hotels (47%) and B&Bs (48%). Hostels are popular (43%) especially among those with a lower disposable income or among the Millennial age group.

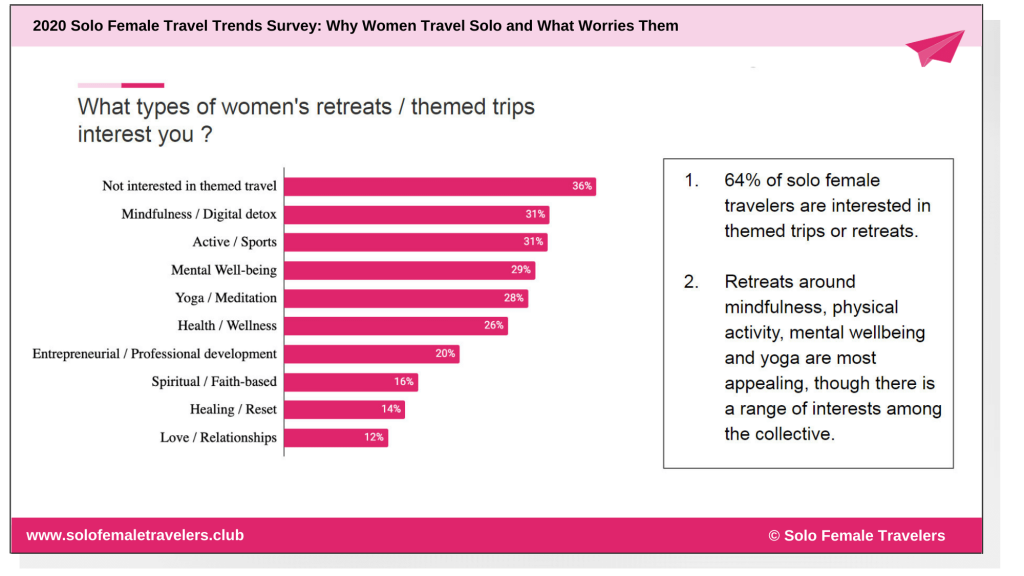

3. 64% of women are interested in themed travel or retreats. Mindfulness, Active, Mental wellbeing and Yoga retreats are the most popular.

1. Price drives travel decisions, but so does a business’ eco-friendliness, its local or female ownership and its social impact; branding is unimportant

Gone are the days when travelers picked trips based on the brand who delivered them, in such a dispersed and fragmented market, women traveling solo value other elements when choosing a travel provider.

We see an increased interested in eco-friendliness and care for the environment and an awakening and increased interest among women traveling solo to support other female owned or female focused businesses. While this is still only mentioned by 18% as a decision factor when picking a travel provider, we believe that awareness is on the rise and this could become the next relevant trend, especially for solo female travelers and for the trips they may book for their families.

Findings / Key Insights

Camila: “I wish the travel industry promoted women owned hostels, hotels, etc.”

- When choosing a travel provider, price is important to 56% of solo female travelers. However, that also means 44% said that price was not that important to their decision.

- Beyond price, women really care about a business’ impact on the environment and its eco-friendliness and 46% said it was important or very important. This is particularly true for Gen X women.

- A business’ ownership is a relevant decision factor for solo female travelers and 37% said they find local ownership important while 18% look for female owned businesses.

- Women also care about about a travel provider’s social impact and whether it participates in projects or contributes to charities that have a positive impact on the society they operate in.

- There are also elements that do not factor into solo female travelers decision and those are whether the brand is recognizable and whether the business has an affinity with them (same religion, same beliefs, same ethnicity).

- We see relevant importance (18%) placed on whether a business is female-owned, and expect this to be a growing trend as more women become aware of the female gap in the travel industry’s senior positions and their ability to have an impact.

Opportunities for the travel industry

- Promote differentiating aspects. Businesses who are already engaged in eco-friendly and social impact initiatives should make them known to potential customers. Those who don’t should start considering the shift in decision factors and reassessing their business focus to engage in a meaningful way.

- Female owned or focused businesses and those who are locally owned should communicate this unique factor in their offering. While there are several certifications that have attempted to provide a seal of approval to eco-friendly and environmentally responsible properties, there is no globally-accepted standard certifying female-owned businesses.

- Travelers care more about a businesses’ purpose and mission than about its brand, this favors smaller players over internationally recognized brands with relevant marketing budgets.

2. Smaller and more personal accommodation options are preferred by solo female travelers

Women traveling solo favor accommodation options that are smaller and cozier. This is because there is value added in being at a small property where you are bound to receive a more personal treatment and where you may be dealing directly with the owner; women also feel an extra layer of safety.

Locally owned businesses have the added perk, as we have seen in the previous finding, of directly benefiting the community rather than an international company headquarters elsewhere. Solo travelers find it easier to make friends in a shared hostel environment frequented by other solo travelers. Hostels with female-only dorms address the safety concerns while providing affordable shared accommodation.

We see vast differences in preferences by age, disposable income and nationality.

Findings / Key Insights

Anonymous: “We need more female only dorms at hostels.”

- 48% of women prefer to stay at smaller bed and breakfasts and 47% choose local or independent hotels when traveling on their own.

- Hostels are a favorite type of accommodation for solo travelers, male and female, as they not only offer affordability but also the ability to socialise meet other travelers who are most likely also traveling solo. 43% of respondents said they choose to stay at hostels on their solo travels.

- Hostels are particularly appealing to younger solo travelers, and accommodation preferences vary significantly by nationality; North Americans prefer local / independent hotels whereas Europeans prefer hostels and Asian favor B&Bs.

- Specialty accommodation options like villas, agrotourism, camping or caravaning, and couchsurfing are preferred by a small percentage of solo female travelers.

- Women prefer entire home rentals (23%) instead of rooms in a shared house (12%) for the extra privacy and safety they provide.

- There is a clear correlation between age and the type of accommodation that travelers prefer. Gen Z favor hostels whereas Boomers prefer boutique hotels and independent accommodation options (eg. apartment rentals). Gen X travelers are the most interested in international hotel chains.

Opportunities for the travel industry

- Homogeneous pricing at hostels. Usually, female-only dorms in hostels cost more than mixed dorms and solo female travelers feel discriminated and taken advantage of for being concerned about their personal safety.

- Female-only floors or accommodation options. Hospitality providers could provide a safe space for women inside their properties. While this is less relevant at higher end or international chains, it can be useful at local or independent hotels who could even take the approach of only welcoming women.

- Couchsurfing is relatively popular although a niche type of accommodation. Alternatives that are female-only have a lot of appeal and several companies have tried to replicate the model, including several Facebook groups where members can swap homes, host each other, meet up, etc.

3. 64% of solo female travelers are interested in themed travel or retreats

Women traveling solo are interested in enriching their experience with something more than mere sightseeing, and themed travel is a growing trend.

While traditional themed trips such as yoga retreats and active holidays (climbing, boxing, hiking, etc.) remain some of the most popular options, there are a range of areas women are interested in. We expect this area to continue to develop, especially towards female-focused and female-owned retreats.

Findings / Key Insights

Anonymous: “Retreats are a great way to connect and empower women”

- 64% of women are interested in themed trips and retreats. This interest is highest among Millennials and lowest among Boomers.

- Mindfulness retreats and those organized around active holidays such as climbing, hiking, trekking, boxing, etc. are the most popular, however, they are only slightly ahead of other themes.

- Age determines the kind of retreat women are interested in joining solo. Millennials are the most interested in retreats that focus on professional development and entrepreneurial skills, whereas Boomers are not interested in these type of trips at all. On the other hand, older women are most keen on health and wellness retreats, as are Gen X travelers.

- Interest also varies by nationality. Women from Africa and the Middle East are the least interested in themed travel while women from North America, Europe and the Pacific are the most interested.

Opportunities for the travel industry

- Launch themed trips. Offer retreats and trips with a purpose to target solo female travelers. Small, themed trips address all the barriers to solo travel for women (affordability and single supplements, safety, fear of getting lost or bored, etc.) and provide a vehicle for women to meet likeminded travelers and form new connections.

- Understanding what type of trip is of interest to each type of solo traveler is important to tailor the offer, without forgetting that in the averages, there are large audiences that could be underserved (eg. while Boomers are largely uninterested in professional development, there are 9% who are, and this is still a relevant segment).

Purchase the Full Reports (3 Reports Available)

For more detailed insights on the findings shared above, including breakdowns by geography, age, income level and travel experience, as well as actionable recommendations from respondents on how they can be better served, our full reports are available for purchase.

Report One

Report Two

Report Three

How We Can Help You: Our Services

Are you looking to better tailor your offer to Solo Female Travelers? Do you want to better understand this segment to adapt your offer? Are you a hospitality leader who wants to train their team to be more aware of the needs and challenges of women who travel solo?

Reach out to us to discuss how we can help you with in-depth data or with our in-depth expertise.

1 Request a bespoke report

Have a query that our published research didn’t cover? Would you like a tailored report looking at a specific solo female traveler segment?

Contact us to request a bespoke report, cutting / segmenting the data in a way that makes a difference to you. Click here to view a list of our variables.

2 Learn how to serve solo female travelers

We provide consultancy services on how your business can better serve / cater to Solo Female Travelers, based on our annual survey insights.

Learn how to adapt and enhance your product to perfectly suit the type of solo female traveler you want to target.

3 Staff training for Female Travelers

We provide corporate and staff training to equip your employees with the knowledge and skills to properly serve Solo Female Travelers.

We offer a range of learning options and can help you adapt your guest welcome processes or your concierge service.

Copyright Notice & Disclaimer

2021 Solo Female Travel Trends is a publication of Solo Female Travelers. Reproduction of this page / report without express permission is not allowed, except in the case of brief quotation. To quote or reference the survey results, it must be accompanied by a link back to this page as the original source.

This article contains information about Solo Female Travel. The information is not advice, and should not be treated as such. There are no representations or warranties, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the information provided. We do not represent, warrant, undertake or guarantee that the use of guidance in the report will lead to any particular outcome or result. The authors do not assume and hereby disclaims any liability to any party for any loss, damage, or disruption due to use (or misuse) of information, conclusions and insights.